According to Kantar’s Global Omnichannel Report private brand is surging ahead of brands. The CPG industry is, as ever, evolving. This time, the movement is a noticeable swing towards Retailer-owned Brands or, as Kantar continues to call them, private labels. It’s not that manufacturer brands haven’t also grown, but it has been a humble increase from 3% to 3.7% in growth. By contrast, private brands have carved an impressive trajectory, with a nine-fold growth in 2022 compared to the previous year.

Share gains and channel impact

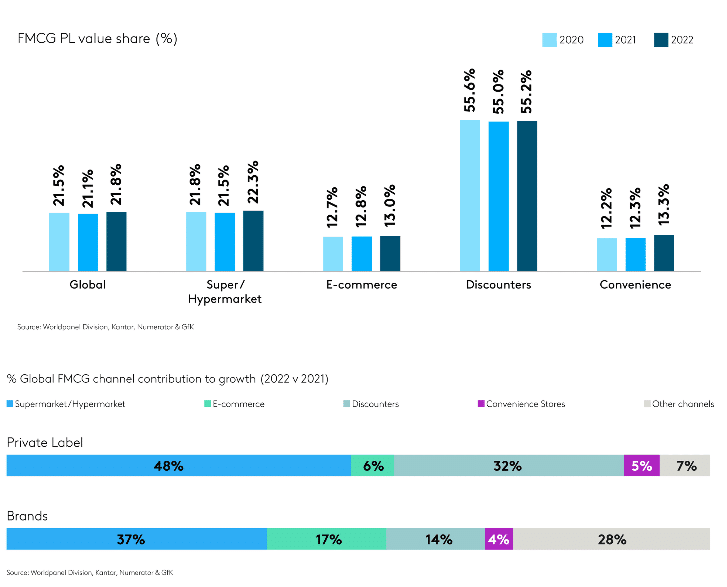

Retailer-owned Brands’ outperformance across all trade channels has resulted in significant share gains across the CPG/FMCG industry. But discounters remain private brands stronghold, commanding over 50% of the market share, while manufacturer brands dominate the online channel with an 87% share in 2022.

Private Brands have carved an impressive trajectory, with a nine-fold growth in 2022 compared to the previous year.

While the success of Private Brand can be partly attributed to the rapid growth of discounters, it is essential to note that 68% of growth originated from outside this channel. A significant proportion of growth stemmed from super/hypermarkets, highlighting their influence.

Consistency across regions

The story of Retailer-owned brands’ success remains consistent across regions, with gains observed in most markets. Europe is the key region for Private Brand, fueled by the importance and growth of the discount channel but not limited to it as already seen.

According to Europanel data from the Big 6 European markets – France, Germany, Great Britain, Italy, the Netherlands, and Spain, the growth can also be attributed to two other factors: firstly, higher-than-average price rises, accounting for over half the rise in private label value share. And the final piece of the puzzle is the migration of shoppers from traditional manufacturer brands, explaining just over a quarter of the growth.

In Asia, Private Brand presence is limited, while Latin America still heavily favors manufacturer brands, accounting for 95% of CPG/FMCG spend.

France stands out as the only European market where Private Brands did not gain share, contrasting with double-digit growth in fourteen markets and 30%+ share in fifteen markets. Colombia and the United States are the only non-European markets in the top 20 biggest Private Brand markets globally. Despite seeing +21% and +7% growth, respectively, Private Brand captures less than one-quarter of CPG/FMCG spending in both, remaining comparatively lower than many European markets.

Colombia and the United States are the only non-European markets in the top 20 biggest private brand markets globally. Despite seeing +21% and +7% growth, respectively, Private Brand captures less than one-quarter of CPG/FMCG spending in both, remaining comparatively lower than many European markets.

Related Incites

2025 EVENTS

TICKETS, SPONSORSHIPS & EXPO BOOTHS NOW AVAILABLE