As Retail Brands (Private Brands) continue to grow data company Numerator has released a new study that examines trends across channels, retailers, consumer groups and product types. Overall, while smaller format grocery retailers lead in private brand share, Walmart dominates in household penetration with four of the top five brands in their portfolio. And as inflation continues to rise, more consumers indicate a willingness to trade from manufacturer products to private brand.

“The days of treating private label products as untrackable are over,” said Eric Belcher, CEO, Numerator. “With market share now approaching 50% in some major categories, CPG manufacturers need visibility into the brand-level performance of private labels today more than ever before. Numerator’s retailer agnostic data uniquely provides the speed and transparency brands need to navigate today’s dynamic market.”

Retailer Findings:

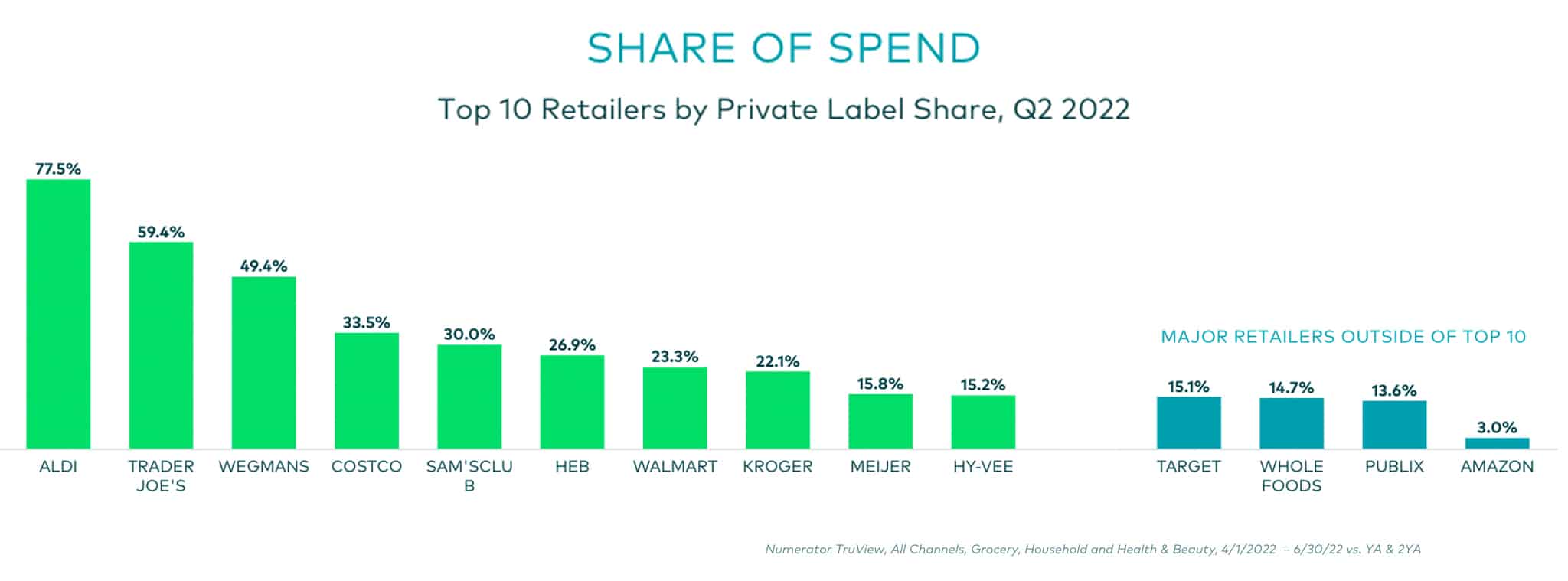

- Smaller format grocery stores lead in CPG private brand share. More than three-quarters (77.5%) of Aldi’s sales are for private label products, followed by Trader Joe’s (59.4%), Wegmans (49.4%), Costco (33.5%), Sam’s Club (30%), HEB (26.9%), Walmart (23.3%), Kroger (22.1%), Meijer (15.8%) and Hy-Vee (15.2%).

- Target (15.1%), Whole Foods (14.7%) and Publix (13.6%) follow closely behind the top 10 in private label share (among Grocery, Household, Health & Beauty).

- Amazon captures significantly lower private brand share in these sectors. While Amazon captures higher private label share among its consumer electronics and home goods products, the retailer posts a private label share of 3% among Grocery, Household, and Health & Beauty products.

- Walmart owns four of the top five private brands. Ranked by household penetration, the top private label brands include four Walmart brands: Great Value (purchased by 72.7% of US consumers), Equate (51%), Marketside (44.2%), and Freshness Guaranteed (40%), followed by Dollar Tree (32.5%).

- Aldi, Target, and Amazon lead in fastest-growing private brands. Aldi private label household penetration grew by 2.3 points from Q2 2021 to Q2 2022, followed by Favorite Day / Target (+2.2 points), Amazon Basics (+1.7), Member’s Mark / Sam’s Club (+1.3) and Kwik Trip (+1.3).

Omnichannel Findings:

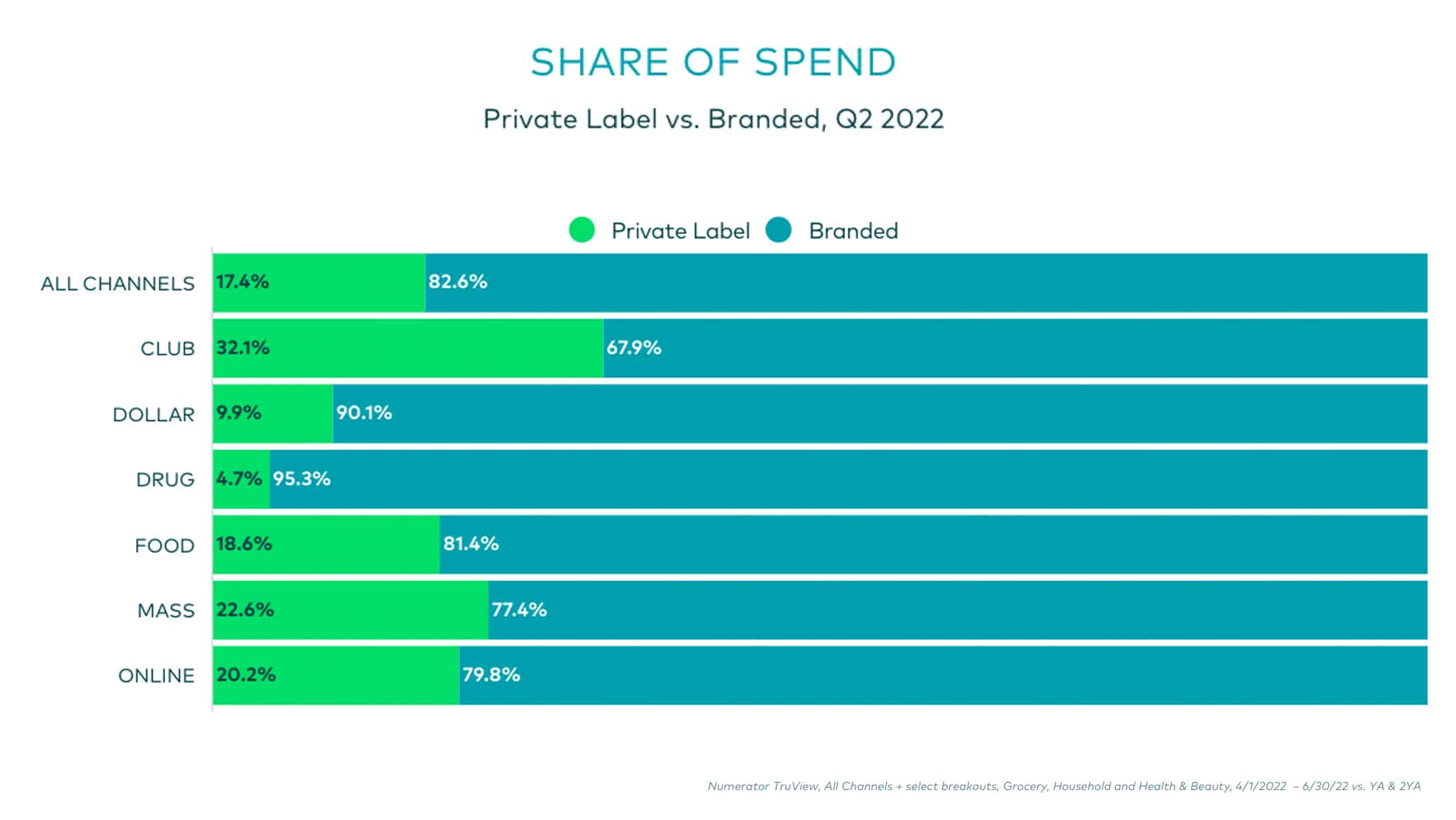

Within the Grocery sector, private brands account for 17.4% of sales, while branded products account for 82.6%.

- Private label grocery share in the Club channel (32.1%) is approximately twice that of other channels. Club is followed by Mass (22.6% private label share), Online (20.2%), Food (18.6%), Dollar (9.9%) and Drug (4.7%).

- Private label grocery share is lowest among low-income households. Despite a perception of private label as a brand for cash-strapped households, private label grocery items hold similar share among low-income (17.1%), middle-income (17.9%), and high-income (17.2%) consumers.

Within the Household products sector, private label brands account for nearly $1 in $5 spent (19.5% of sales), compared to 80.5% for branded items.

- In the Club channel, private label products account for more than one-third of all Household product sales. Private label Household products share in the Club channel (35.5%) is followed by Mass (19.4%), Dollar (19.2%), Food (18.7%), Online (13.1%) and Drug (8.9%).

- Online private label share continues to grow in the Household sector. While Online holds the second-lowest share (13.1%) for private label products, it was the only channel to see consistent growth over the past two years (+3.1 points vs YA, +0.6 points vs 2YA).

Within the Health & Beauty sector, private brands account for more than $1 in $10 of consumer spend (11.9%, compared to 88.1% for branded items).

- The Dollar channel closely trails the Drug channel in Health & Beauty private label share. The Drug channel represents the highest share of Health & Beauty private label sales (18.4%), followed by Dollar (17.7%), Mass (16.9%), Club (14.2%), Food (8.7%) and Online (5.2%).

- Health & Beauty private label share varies across income levels. Among low-income consumers, private label products account for 17.2% of sector spending, compared to 14.9% for high-income consumers.

Consumer Sentiment Findings:

- High-income consumers have the most favorable opinions of private label products. More than half of high-income shoppers (56.9%) rate private label products’ value as excellent/above average, compared to 55.2% of middle-income and 52.5% of low-income shoppers who said the same.

- As inflation continues to rise, price is becoming more important than brand name for many consumers. In recent months, the number of consumers who say price is more important than brand name has grown across all income levels.

- More middle and high-income consumers are buying private label to save money. Nearly two in five high-income (39.5%) and middle-income (38.8%) consumers are purchasing private label as a cost-saving measure.

Methodology: Comparison periods include 4/1/2022 – 6/30/2022 vs YA and 2YA. Market share data is sourced from Numerator TruView and includes all channels for Grocery, Household, and Health & Beauty sectors. Income brackets are defined as High income (>$80k annually), middle income ($40k – $80k), low income (<$40k). Household penetration is sourced from Numerator Insights. The Numerator Private Label Survey is an ongoing survey with 10k+ responses monthly.

Related Incites

2025 EVENTS

TICKETS, SPONSORSHIPS & EXPO BOOTHS NOW AVAILABLE