Back in 2019, the predictions about private brand’s ascendency were flying thick and fast.

Sooner or later, said business analysts, consumers would come to perceive private label products as “trustworthy competitors to national brands”. The proviso was that retailers had to act strategically, applying tiering and differentiation and keeping their focus trained on quality and packaging design.

Skip forward two years and a pandemic later, and their optimism has largely proved spot-on – with transformations in private brand coming faster than expected. A so-called perfect storm of supply chain disruptions, financial uncertainty, and creeping inflation has been a major driver, sending customers in search of economically superior equivalents to more and more products.

But retailers’ efforts to boost variety and quality perception can’t be downplayed. According to a 2020 survey of U.S. consumers by Connecticut-based consultancy Daymon, more than 80% of US customers rated private brands as good as or better than equivalent branded products. Today, private brand sales are growing at twice the speed of national brands. It’s a vindication, of sorts, for us long-time private brand folks.

But what happens next with private brand? How can retailers continue to build on its successes and its current position to turn the private brand peak into something much more permanent?

To do this private brand must continue to evolve from simply being a “cheaper version” of a given product, as it adopts a much more sophisticated model. This is happening in real-time, even as private brands grow in sectors which have been less commonly associated with private brand, such as fashion and pharmaceuticals.

Retailers have a lot to gain by investing in private label markets outside of food, says market research consultancy Mintel. Private label drinks ranges, for example, are named as a dark horse sector affording ample opportunity to draw customers in through innovation.

Rather than replicating a national brand, private brands can offer something completely new and exciting, as well as the promise of “everyday luxury”, with the ultimate goal of aligning with the current demands of consumers and deepening loyalty.

Pure, healthy, and nearby

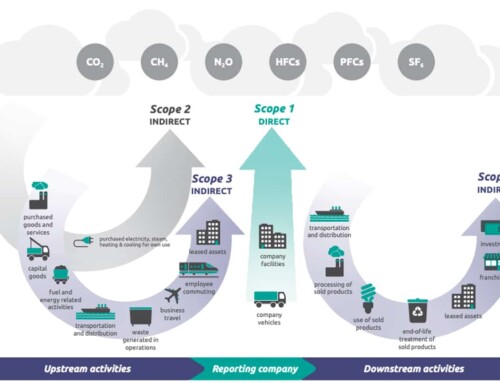

But staying relevant will take much more than premiumization. In the current landscape, consumers are wizened to the shortcomings of “just in time” supply chain models, and, following widespread media coverage around climate change, they are taking a closer look at factors such as integrity, authenticity, and sustainability.

This is reflected in the current surging popularity of health and wellness products, which tend to attract a more mindful consumer. In turn, some brands have been able to mount a quick response. For example, in May CVS announced that it would be expanding its offerings under multiple private brands such as its new Live Better by CVS Health brand, bringing more sustainable options to shelves, including water in BPA-free recyclable boxes, menstrual care products made from 100% cotton and beauty items free of phthalates and formaldehyde.

All of the above would suggest that there’s plenty to keep the minds of brand leaders busy as they set about developing fresh and compelling strategies to maximize the performance of private brands in this new era.

Not only can they highlight the innovative and premium nature of their offering, but they can also (where not a falsehood) incorporate the right USPs/callouts to reflect an awareness of consumers’ heightened focus on authenticity and sustainability.

Elevated branding and packaging, with a consistent look and feel across all products, will be essential to these strategies and will work to boost perceptions of quality in their own right. Since the profiles of private brands are often complex – with multi-category offerings which span a variety of tiers and pack front types – a well-considered overarching brand architecture is vital.

And, as the principal physical touchpoint of the brand (and in our increasingly digital world the only one they will unquestionably come in contact with), the packaging is a crucial piece of the puzzle not to be undervalued.

Where private brand will go from here isn’t set in stone, but should brands once again focus on differentiation, quality, and packaging, this will almost certainly ensure continued robust performance, with gains in market share and prominence at the shelf edge, as well as in consumer perception.

It’s up to brands, though, to keep up their end of the bargain, and to continue innovating relentlessly.

Matt Caldwell

Global Creative Director, Equator

Related Incites

2025 EVENTS

TICKETS, SPONSORSHIPS & EXPO BOOTHS NOW AVAILABLE