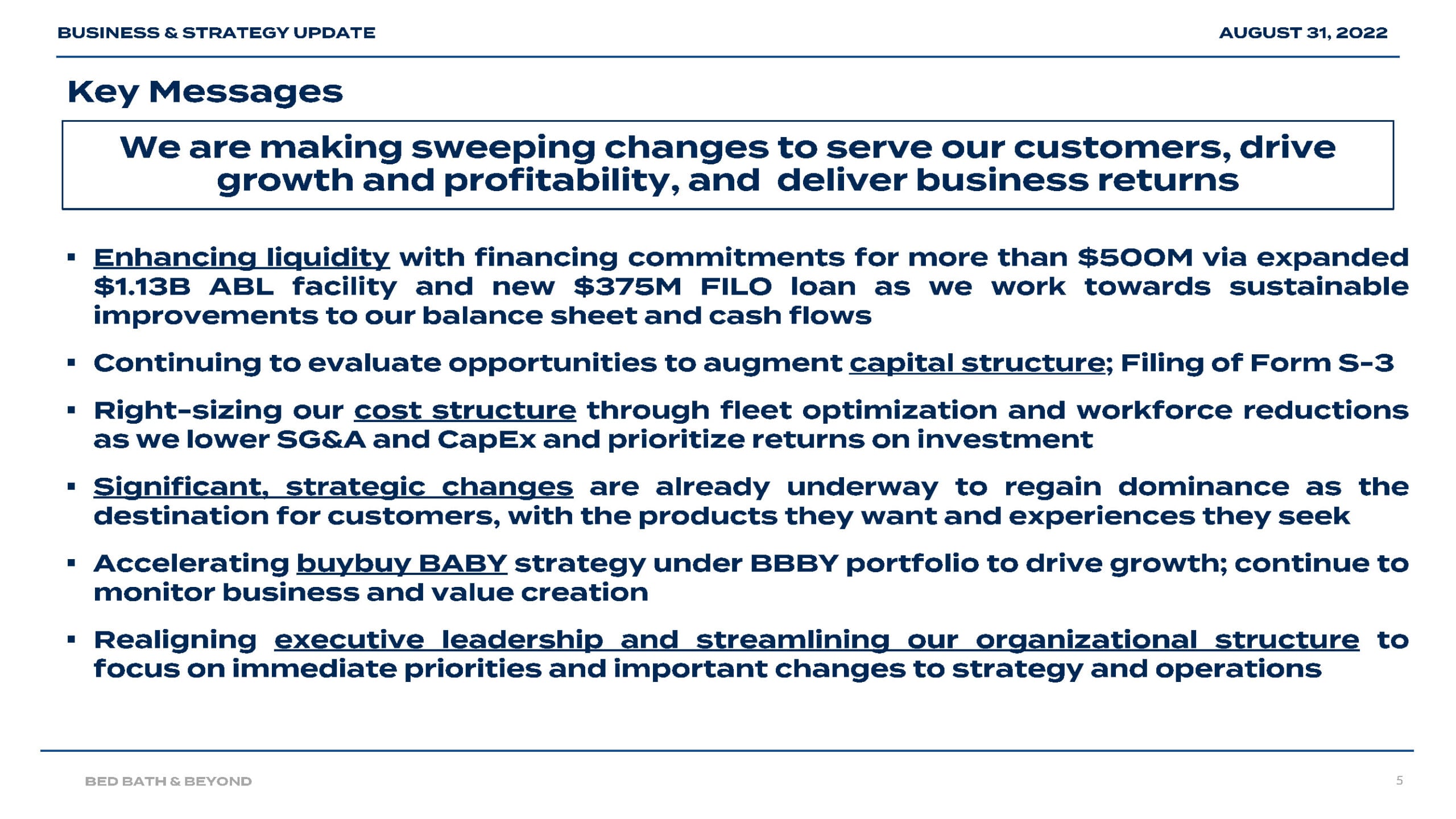

Beleaguered home retailer Bed Bath & Beyond today announced a strategic and business update focused on changes intended to stave its losses and survive. The plan leans heavily on new leadership, cost cutting, store closures, ubiquitous national brands and reducing private brands. It remains to be seen whether the retailer will be able to create compelling differentiation that shoppers will chose over Amazon, Target, Ikea, Macys or Lowe’s Home Improvement.

Sue Gove, Director & Interim Chief Executive Officer commented, “We are embracing a straight-forward, back-to-basics philosophy that focuses on better serving our customers, driving growth, and delivering business returns. In a short period of time, we have made significant changes and instituted enablers across our entire enterprise to regain our dominance as a preferred shopping destination for our customers’ favorite brands and exciting products. We command a special presence in the Home and Baby markets, and we intend to fulfill our opportunity to be the category retailer of choice.“

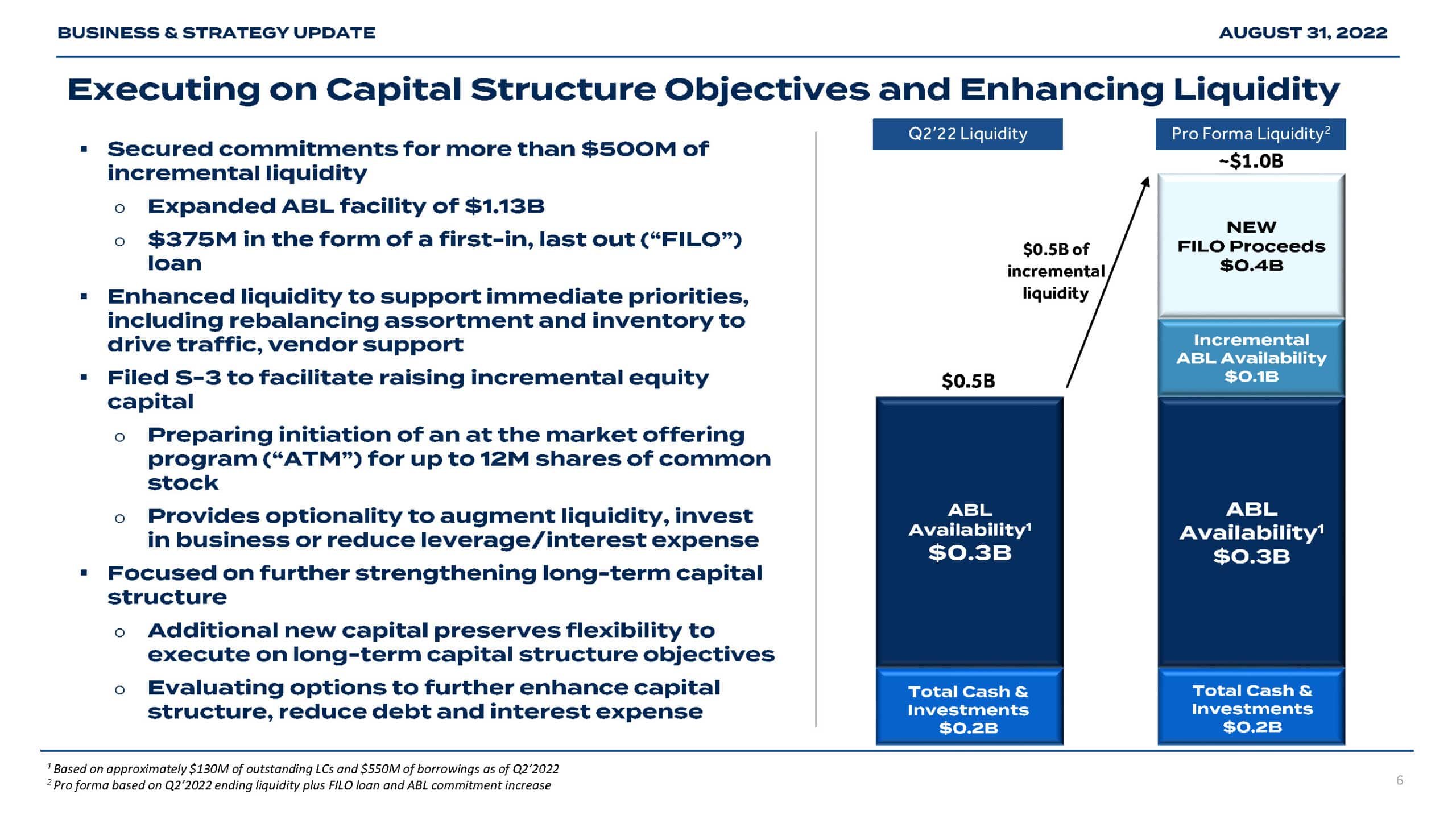

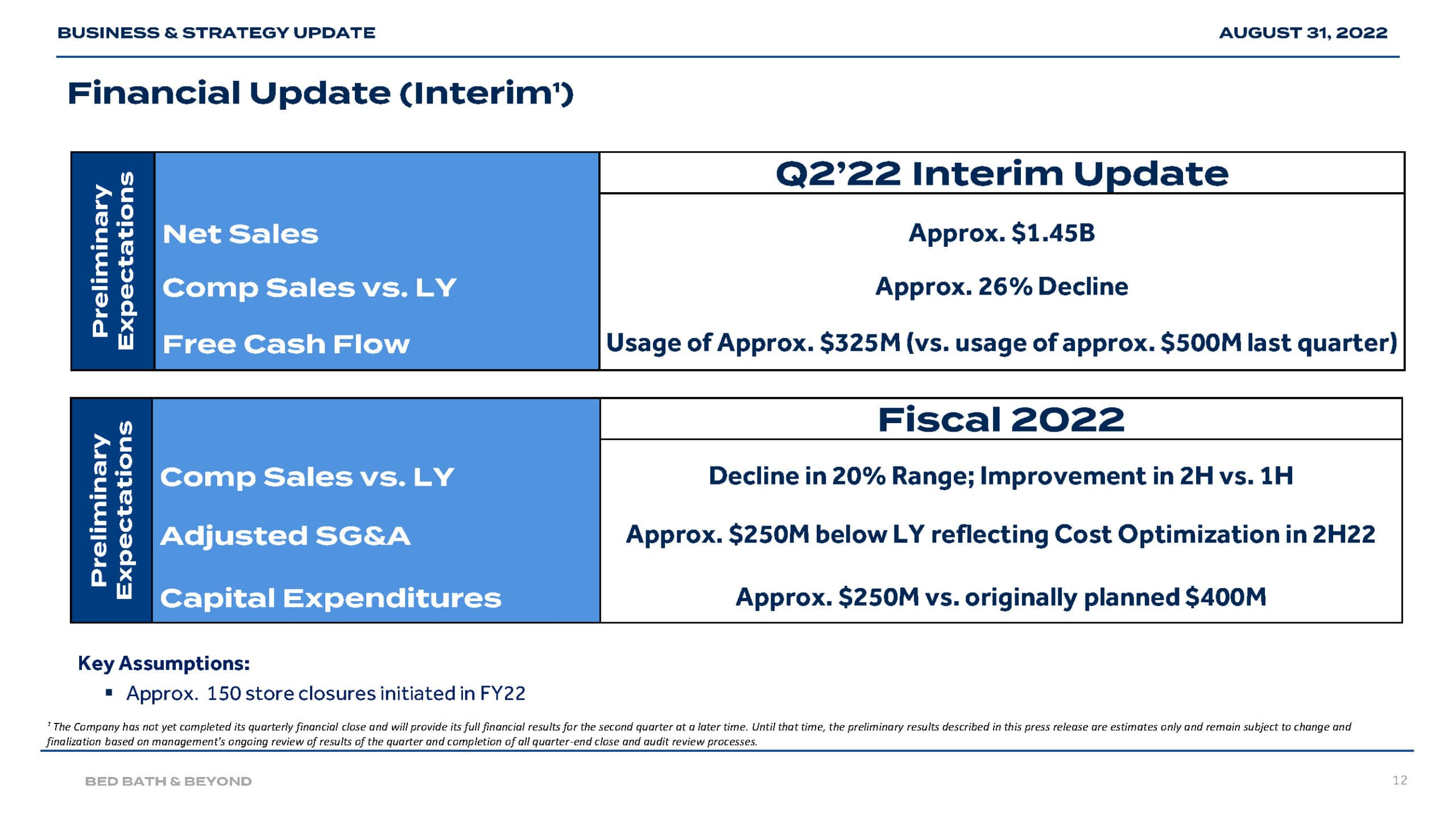

Ms. Gove continued, “We are working swiftly and diligently to strengthen our liquidity and secure our path for the future. We have taken a thorough look at our business, and today, we are announcing immediate actions aimed to increase customer engagement, drive traffic, and recapture market share. This includes changing our merchandising and inventory strategy, which will be rooted in National Brands. Additionally, we are focused on driving digital and foot traffic, as well as optimizing our store fleet. We believe these changes will have a widespread positive impact across customer experience, inventory assortment, supply chain execution and cost structure. The customer underpins our decisions, and we are committed to delivering what they want while driving growth, profitability, and financial returns.”

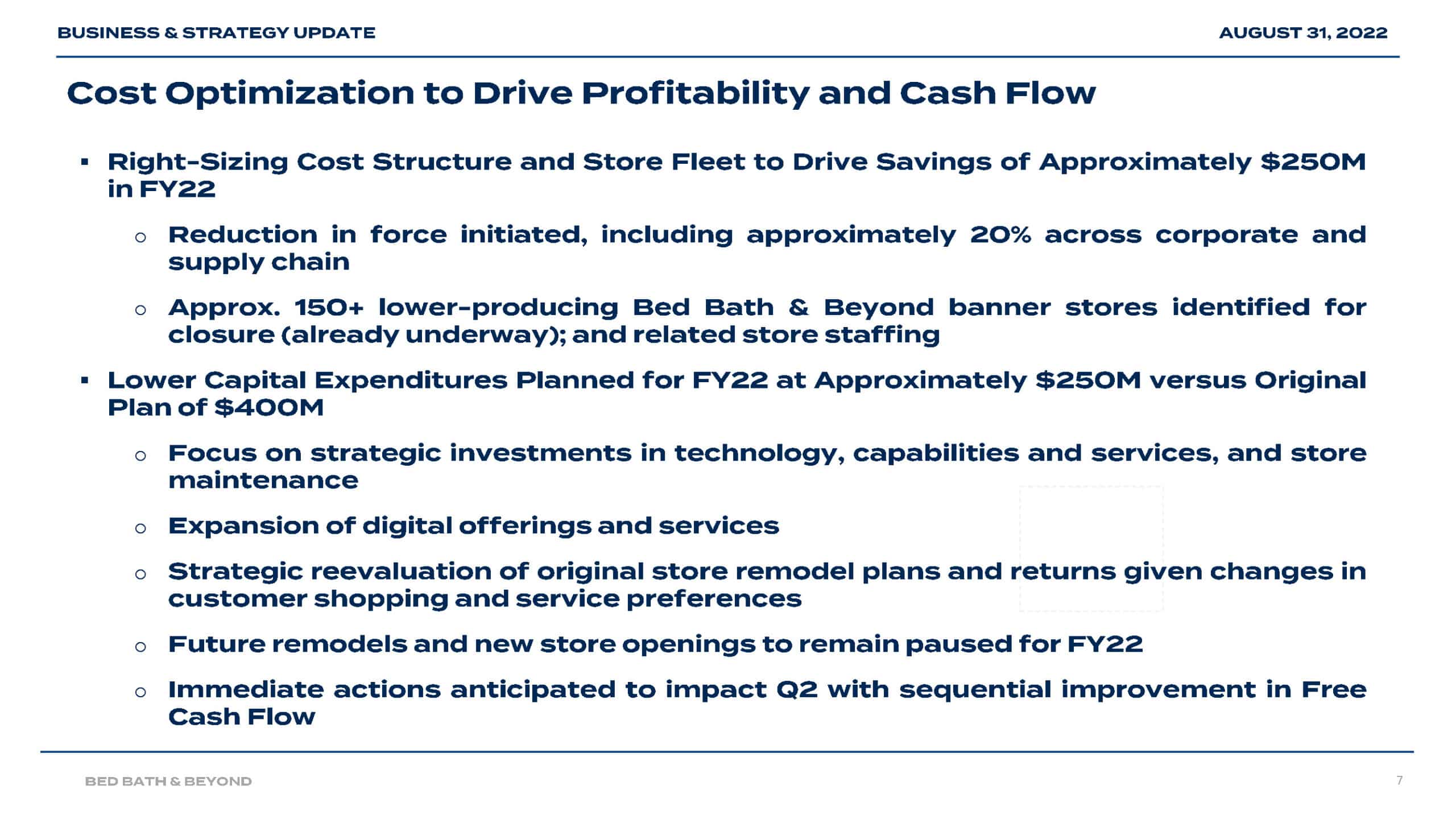

The retailer is taking what it calls swift action in its Bed Bath & Beyond banner to rebalance its assortment and improve inventory. These include adjusting merchandise allocations to lead with customer preference and bringing back popular national brands and introducing new, emerging direct-to-consumer brands. BB&B is working expeditiously to increase its National Brands inventory where possible and will increase inventory penetration by 20% over the long term. The retailer hopes to achieve a lower cost structure by reducing their Retail Brand(private brand) development and support.

BB&B will exit a third of its private brands by discontinuing three of the nine: Haven, Wild Sage and Studio 3B. The inventory across the six remaining brands Simply Essential, Nestwell, Our Table, Squared Away, H for Happy, and Everhome will be substantially reduced to 20%, reflecting a cautious approach.

Bed Bath & Beyond teams are working closely with supplier and vendor partners to ensure customers have access to a strong assortment of their favorite brands across both store and digital channels. The Company will host a supplier event in early-Fall 2022 to build on new and strengthen existing relationships, address any issues to ensure strong support, and work collaboratively to create the best experience for shared customers.

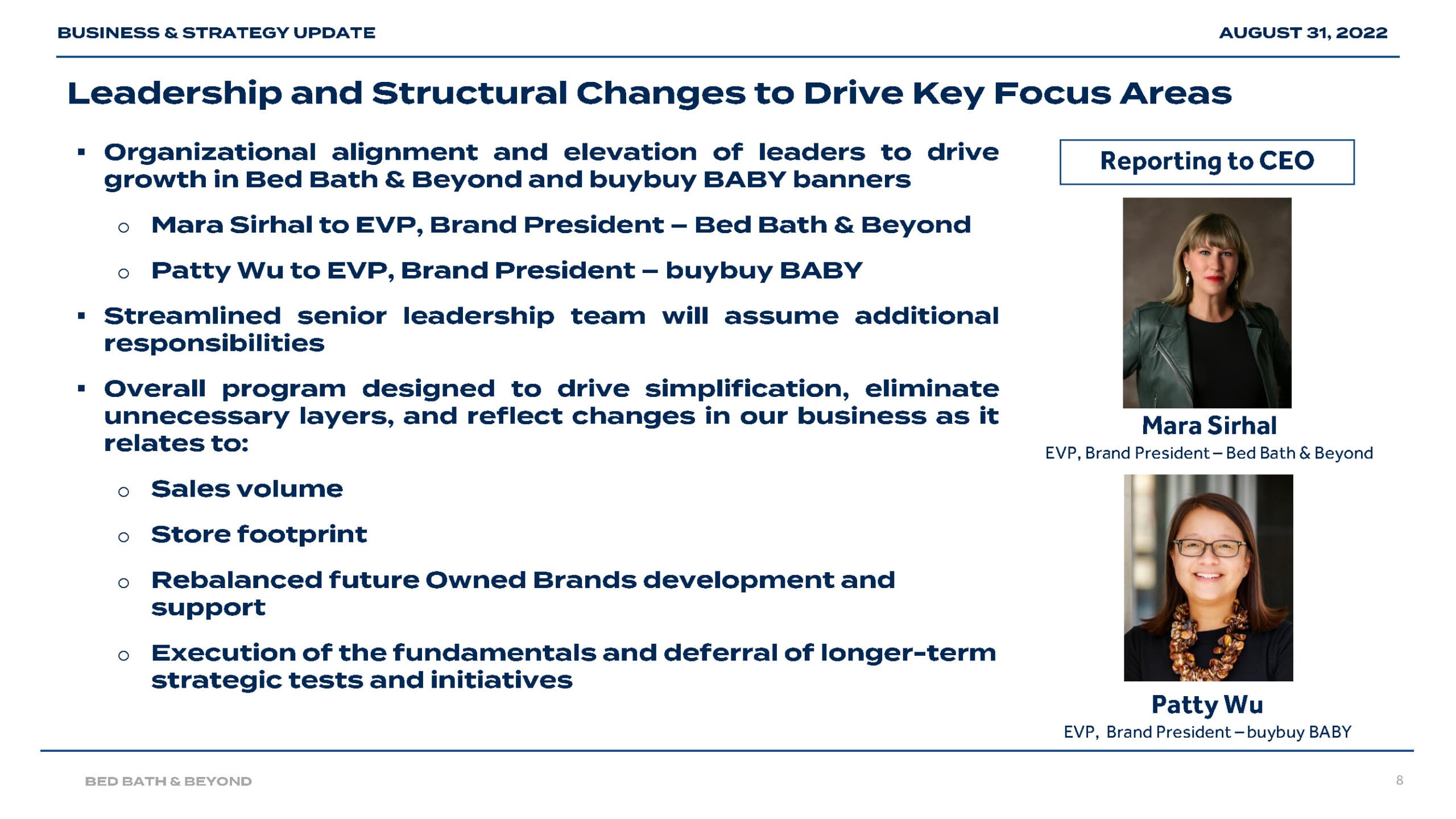

The announcement realigns the retailer’s executive leadership team to reflect the strategic priorities and changes announced today. Mara Sirhal has been appointed to Executive Vice President and Brand President of Bed Bath & Beyond. In addition, Patty Wu has been promoted to Executive Vice President and Brand President of buybuy BABY. The newly created Brand President roles will be responsible for each banner’s merchandising, planning and allocation, brand marketing, and stores, and will report directly to Ms. Gove.

Ms. Sirhal most recently served as the Company’s Executive Vice President and Chief Merchandising Officer for the Bed Bath & Beyond banner. Ms. Sirhal joined the Company in January 2021 as Senior Vice President and General Manager for Harmon to lead all operational aspects of this business. Ms. Sirhal’s retail experience includes nearly 20 years across a variety of categories in merchandising, product development, planning, digital, inventory management, supplier diversity, and leased businesses at Macy’s, Inc.

Ms. Wu has served as the Senior Vice President and General Manager of buybuy BABY since joining the Company in January 2021. Prior to buybuy BABY, Ms. Wu held several executive leadership positions across retail and business, including the roles of Chief Commercial Officer of Beautycounter, Chief Commercial Officer and General Manager of the Baby Division at The Honest Company, as well as senior management roles at Mattel, Inc. and Walmart.

In conjunction with these changes, the Company has eliminated the Chief Operating Officer and Chief Stores Officer roles. Accordingly, John Hartmann and Gregg Melnick will be departing the Company.

CEO Search

Harriet Edelman, Independent Chair of the Bed Bath & Beyond Inc. Board of Directors, said: “It is clear from the focused work to date, evidenced by the breadth of today’s announcements, that Sue has quickly formulated and executed important changes to customer-facing strategy, operations, management team, cost structure and liquidity. On behalf of the entire Board, we are very pleased and confident that Sue’s dedicated leadership will continue to have a significant, positive impact on Company performance. Regarding our search for the Company’s next Chief Executive Officer, the Company’s Board of Directors previously announced that it retained nationally recognized firm, Russell Reynolds. We are in the earliest phase of the search process and will provide an update when appropriate.”

Related Incites

2025 EVENTS

TICKETS, SPONSORSHIPS & EXPO BOOTHS NOW AVAILABLE