Yesterday (February 21) Bentonville giant Walmart held its Q4 2023 Earnings Call. Doug McMillon, President, Chief Executive Officer & Director, Walmart, Inc. began the call on an optimistic note:

“Good morning, everyone, and thanks for joining us. We’re excited about our momentum. The team delivered a strong finish to the year, and as our results in the last two quarters show, we acted quickly and aggressively to address the inventory and cost challenges we faced last year. We built momentum in the third quarter and that continues. We’re well-positioned to start this fiscal year.

“Good morning, everyone, and thanks for joining us. We’re excited about our momentum. The team delivered a strong finish to the year, and as our results in the last two quarters show, we acted quickly and aggressively to address the inventory and cost challenges we faced last year. We built momentum in the third quarter and that continues. We’re well-positioned to start this fiscal year.

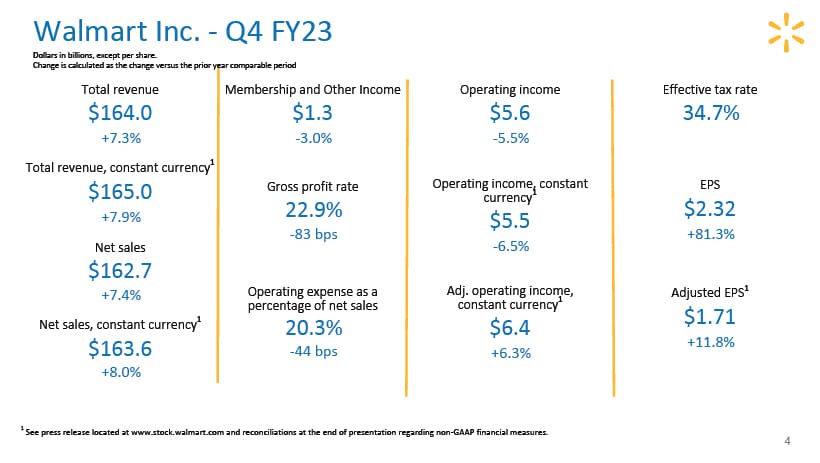

For fiscal 2023, we added $38 billion in sales globally and we crossed $600 billion in revenue for the first time in our company’s history. Globally, eCommerce now represents more than $80 billion in sales and over 13% of our total sales. Walmart US grew sales by more than $27 billion. International had another strong year with sales and profit growth of about 9%, excluding divestitures, restructuring and currency.”

Walmart U.S. comp sales grew 8.3% and 13.9% on a two-year stack. eCommerce growth was 17% and 18% on a two-year stack. The retailer continued to gain market share in grocery.

“We’re excited about our momentum. The team delivered a strong quarter to finish the year, and as our results in the last two quarters show, they acted quickly and aggressively to address the inventory and cost challenges we faced last year. We built momentum in the third quarter and that continues. We are well-positioned to start this fiscal year,” said McMillon.

John David Rainey, Chief Financial Officer & EVP, Walmart, Inc. went on to discuss the numbers and of course Retail-owned Brand (private brand) growth.

“Let me briefly reference key highlights for Q4 by segment. For Walmart US, comp sales were strong throughout the quarter. And December was the largest sales month in Walmart US history. This was led by strength in food sales, which increased high teens, partially offset by a mid-single-digit decline in general merchandise sales, with softness in toys, electronics, home and apparel.

“Let me briefly reference key highlights for Q4 by segment. For Walmart US, comp sales were strong throughout the quarter. And December was the largest sales month in Walmart US history. This was led by strength in food sales, which increased high teens, partially offset by a mid-single-digit decline in general merchandise sales, with softness in toys, electronics, home and apparel.

The effects of product mix shifts have negatively impacted our margins. Over the last year, grocery and health and wellness sales, which have a lower margin than general merchandise, have increased by 330 basis points as a portion of our mix. We continue to see strong share gains in grocery, with nearly half coming from higher-income households, and private brand penetration increased over 160 basis points as customers prioritize value. Inflation remained high, up mid-teens in food categories, which was similar to Q3 levels.”

As always the conversation becomes a bit more exciting in the unscripted Q&A portion of the call.

In response to a question from Kate McShane, Analyst, Goldman Sachs & Co. LLC Walmart CEO John Furner discusses the acceleration of private brand.

“Hey, Kate. It’s John. Good morning. Thank you for your question. First, I’d just anchor what we’re doing in the

purpose of the company is to help people save money, and live better. So we’re constantly thinking about making sure that our values are appropriate given what’s going on in the relative marketplace. And as Doug alluded to earlier, we’re encouraged by the price positioning relative to the market and will continue to work on that.

Externally I wouldn’t call it any major shifts in what we’re seeing in terms of promotion. There has definitely been a shift and we see this internally as well an acceleration in the fourth quarter to more private brand versus branded product. That shift really began last March and continued all year, in the fourth quarter got a bit stronger. We don’t set targets for branded versus private branded. We want to be there for any customer and make sure quality and value are right across all product lines but there’s definitely some acceleration to private brands in the last 90 days.”

Related Incites

2024 EVENTS

TICKETS, SPONSORSHIPS & EXPO BOOTHS NOW AVAILABLE